ABB poinformowało dzisiaj o planie przejęcia firmy B&R (Bernecker + Rainer Industrie-Elektronik GmbH) – największego niezależnego dostawcy urządzeń i oprogramowania z zakresu automatyki przemysłowej oraz maszynowej. Firma zatrudnia 3 tys. osób w ponad 70 krajach i ma obroty ponad 600 mln dolarów rocznie. Oferta B&R ma być zintegrowana z portfolio produktów ABB.

Kluczowe informacje dotyczące akwizycji

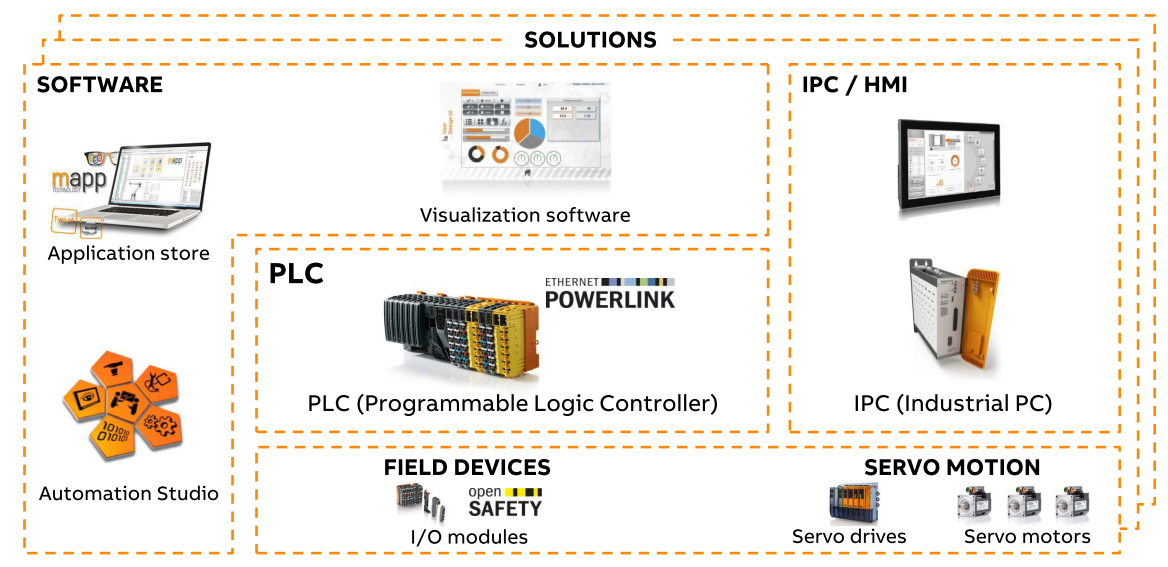

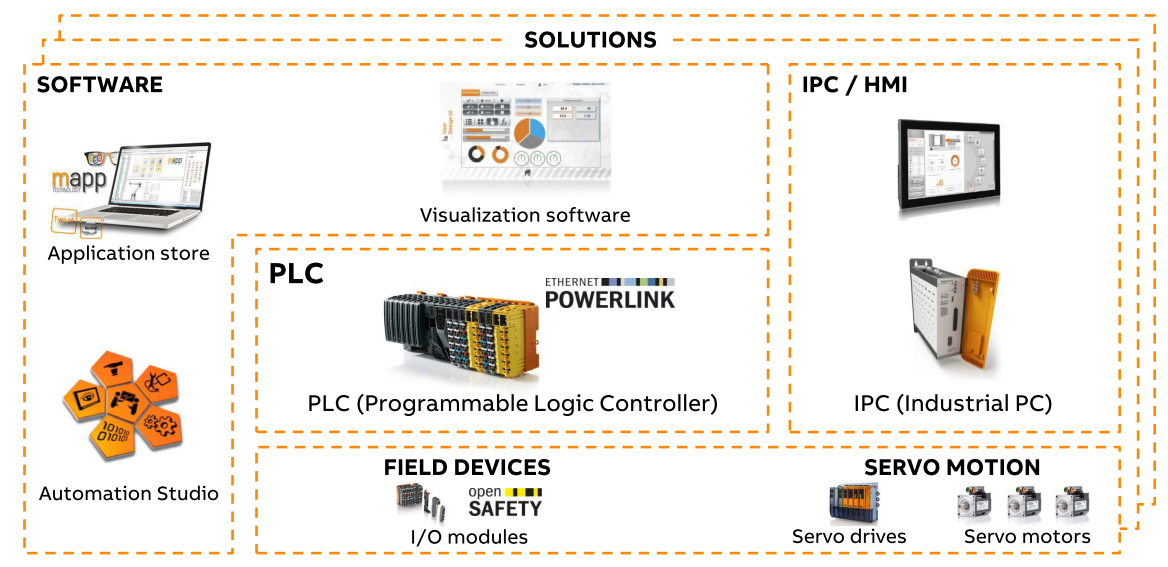

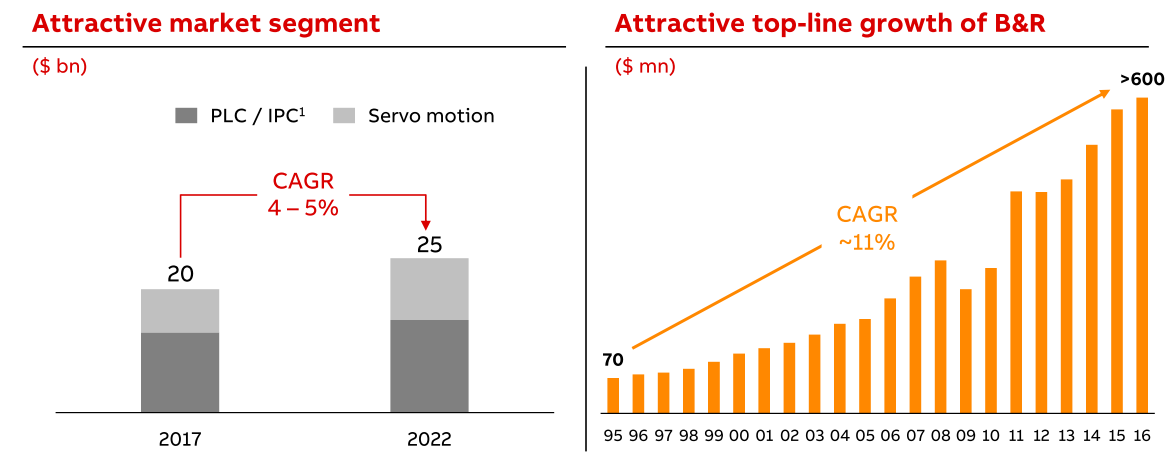

- B&R jest innowatorem w zakresie technologii PLC, Industrial PC oraz rozwiązań serwonapędowych;

- Firma osiągnęła w ostatnich dwóch dekadach średniorocznych wzrost (CAGR) na poziomie 11% i, w ostatnim okresie, roczną sprzedaż powyżej 600 mln dolarów;

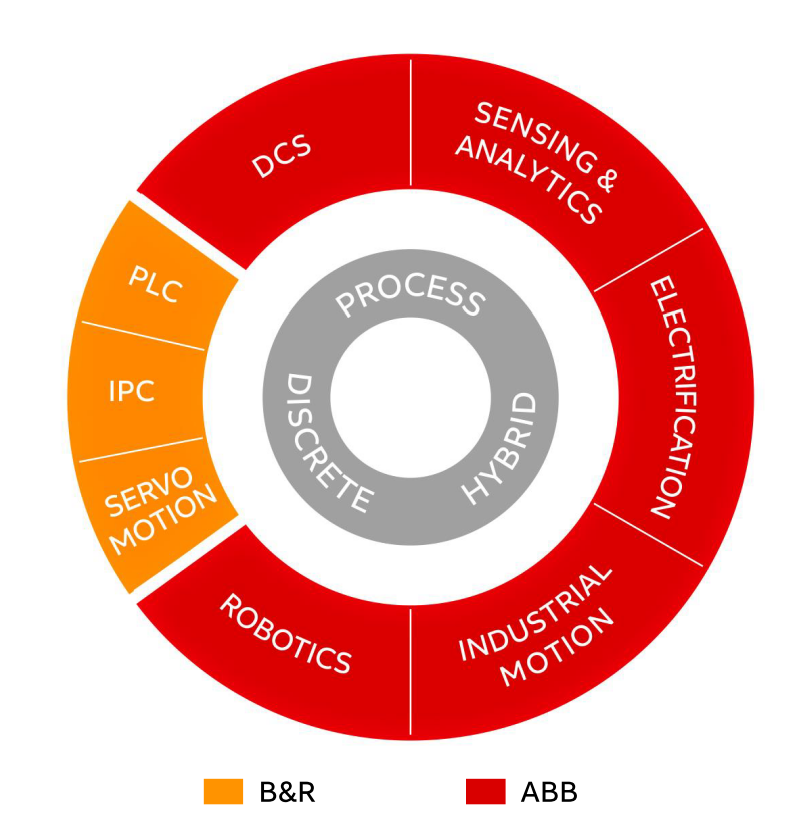

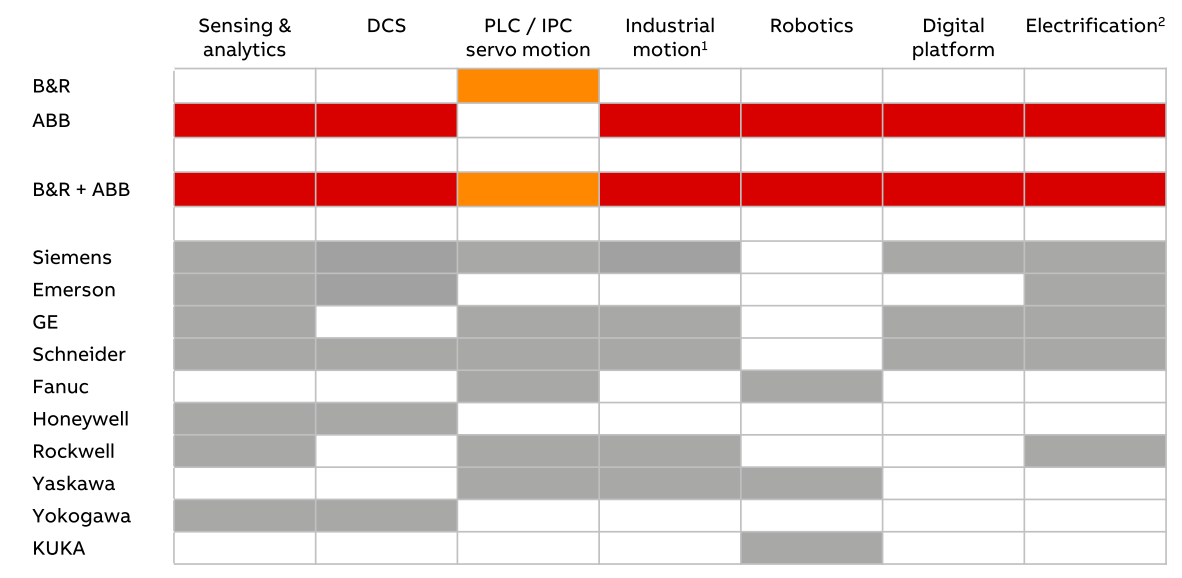

- ABB przejmie B&R – akwizycja ma stanowić dopełnienie oferty produktów i technologii ABB w zakresie automatyki przemysłowej;

- Planowana jest kontynuacja strategii wzrostowej B&R z celem średnioterminowym związanym z przekroczeniem obrotów 1 mld dolarów rocznie;

- Rozwiązania B&R z obszaru Internetu Rzeczy i oprogramowania wzmocnią ofertę cyfrową w ramach ABB Ability;

- Centrala firmy B&R w Eggelsbergu (Austria) będzie pełniła rolę centrum kompetencyjnego ABB w zakresie automatyki maszynowej i przemysłowej;

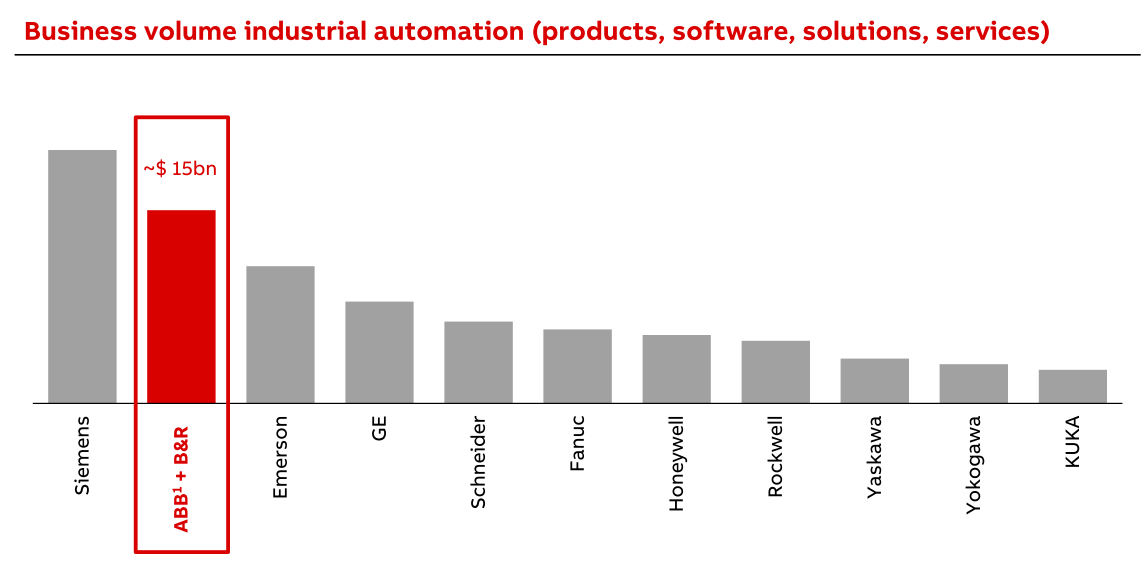

Ocena pozycji rynkowej ABB po przejęciu B&R (źródło: ABB)

- Zakup zostanie sfinansowany w gotówce, wartość transakcji nie została ujawniona;

- Spodziewany termin zamknięcia transakcji: lato 2017.

Źródłem przedstawionych informacji jest firma ABB.

Update: Ważna informacja dla klientów firmy B&R

B&R pozostanie odrębną organizacją prawną z siedzibą w Austrii i stamtąd nadal będzie zarządzać swoimi biurami na całym świecie. Zespoły menadżerskie, zarówno w Austrii jak i w poszczególnych regionach świata, pozostaną niezmienione. Nie nastąpią zmiany w relacjach biznesowych pomiędzy B&R i klientami firmy.

![WIW2023 – więcej wydarzeń targowych [zdjęcia, filmy]](https://przemysl-40.pl/wp-content/uploads/tytulowe-5-218x150.jpg)

![Warsaw Industry Week 2023 [dużo zdjęć, komentarze]](https://przemysl-40.pl/wp-content/uploads/WIW-218x150.jpg)